How do I know if I’m being scammed?

Imposters can gain your trust – then steal your money

Article published: August 27, 2021

Almost 500,000 imposter scams were reported in 2020, and many of them start like this:

You get an urgent message. There’s an issue with your tax return or your Social Security account. You face legal action – or even arrest – unless you pay immediately. Or your bank account has been compromised. Or your computer is infected with malware. Or a loved one traveling overseas is in jail and needs immediate help.

These are among the lures frequently used in imposter scams – the most common type of fraud reported to the Federal Trade Commission. It logged almost 500,000 of them in 2020. Victims lost $1.2 billion. So why do so many people still wonder, “Am I being scammed?”

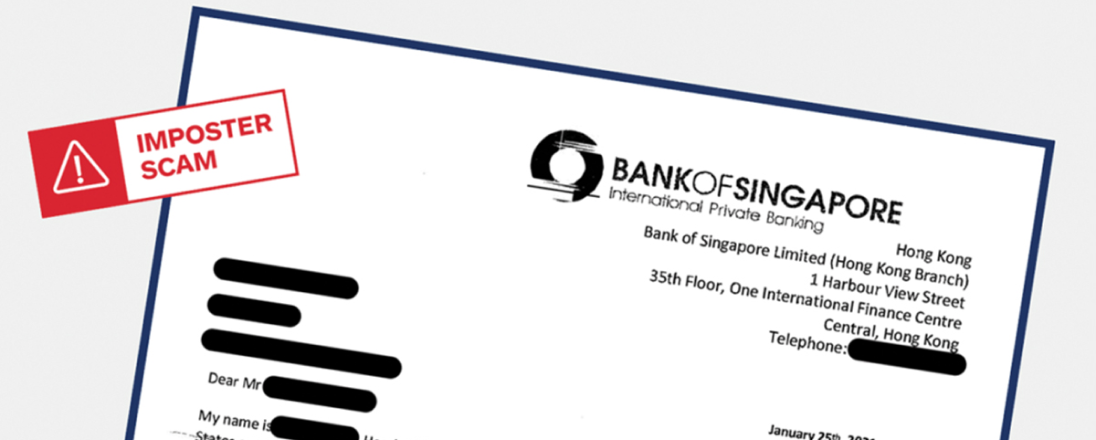

Imposter scamming techniques typically start with an unsolicited phone call, email, text or social media message. The fraudster impersonates people or organizations you trust, such as a government agency, your bank, a local utility, a charity – even a relative or friend.

Some imposters might bring good news, telling you that you won a lottery or a government grant or are getting an inheritance. You’ll probably be told that all you have to do is make a payment (often by gift card) or provide your Social Security, bank account or debit card number. Once you send money, you never hear from the scammers again – until they return with another hoax (such as pretending that, if you send more money, they’ll help you recover your earlier losses!).

Some crooks create fake personas on dating sites or social media; they slowly cultivate a relationship with you. But they’ll eventually ask for money – for a reason that sounds plausible and by a method you can’t trace. Here are some steps you can take to identify an imposter and protect yourself from being scammed.

To help avoid being conned, follow these 6 steps:

- Confirm independently whether a business, utility or government agency is really trying to reach you. A threat of arrest or legal action is likely a scam. Misspellings and grammatical errors are red flags.

- Never give anyone you don’t know remote access to your computer or pay them to “fix it.” Apple or Microsoft will not contact you for tech support unless you request help and they won’t ask for personal information.

- Stop all contact if you begin to suspect that someone you met online is an imposter.

- Never give your Social Security number, credit card details or other sensitive information over the phone. Only do so if you are absolutely sure of the person you’re dealing with.

- Don’t send money or gift card payments to someone you don’t know, someone you think you may know but are not sure or someone you’ve met only online.

- Don’t rely on caller ID to determine whether a call is legitimate. Scammers use spoofing tools to make it appear that they’re calling from genuine government or business numbers.

Imposters are always thinking up new scamming techniques to steal your money. By doing your due diligence and following these simple steps, you can reduce your risk of being scammed.