Ready to retire early?

10 questions to consider to ensure you’re ready to retire early.

Article published: December 21, 2021

Unprecedented. How many times did you hear this word during the height of the Covid-19 pandemic? From the tragic loss of life to shelter-in-place orders to severe health concerns and even toilet paper shortages, Covid-19 ushered in a wave of unprecedented challenges for us all.

The Covid-19 crisis also triggered a “life is too short” mindset among some Americans – as people reevaluated their priorities. As a result, many Americans chose to resign or retire early and some are still thinking about a partial retirement as part of what some are calling the Great Resignation of 2021.

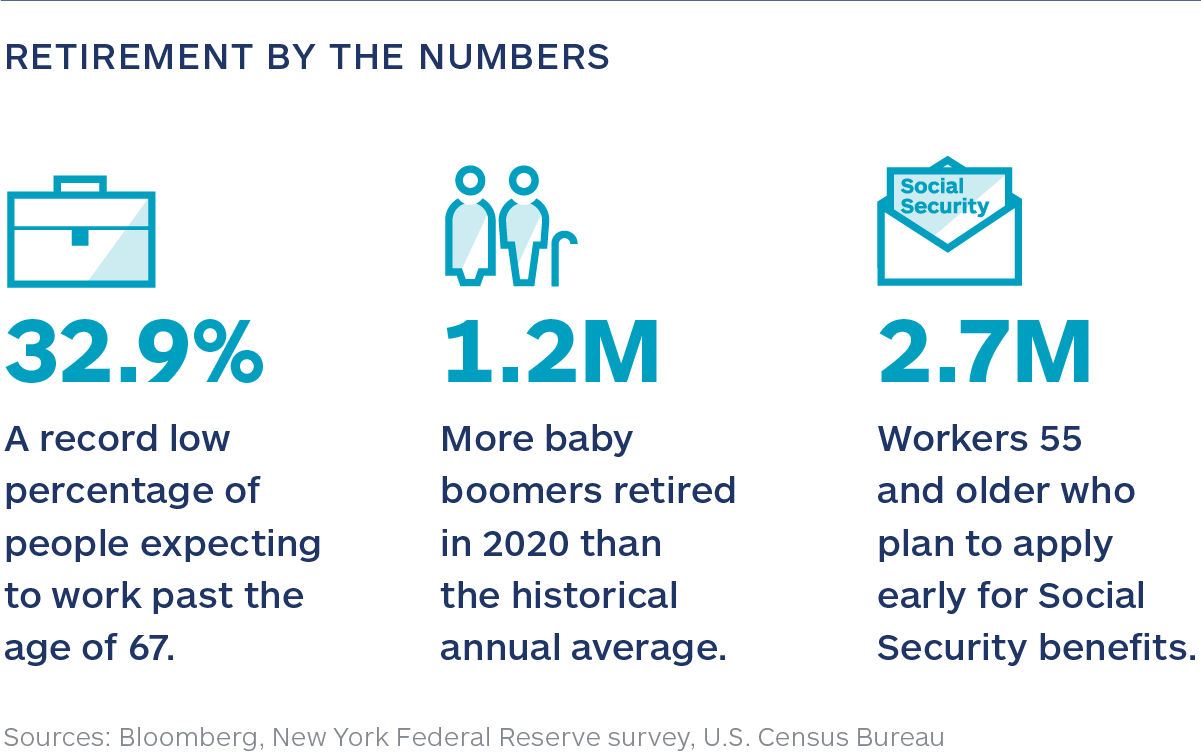

The recent rush to retire

In fact, about 2.7 million Americans aged 55 and older are considering retiring years earlier than expected due to the pandemic, according to government data. For some, the strain of managing an increased workload or balancing a work-from-home lifestyle caused significant fatigue – leading many to begin preparations for an early exit from the workforce. For others, the desire to “live life to the fullest” triggered the decision to retire early.

The significant surge in the stock market and home values caused by the economic fluctuations in 2020 also contributed to the early retirement paths for some. Assets for those aged 55 to 69 increased by $4.2 trillion, and real estate assets increased by nearly $750 billion, according to Federal Reserve data. This bolstered the retirement funds of many older Americans, allowing them to consider exiting the workforce earlier than previously expected.

Are you ready to retire early?

If you’re contemplating early retirement, it’s essential to holistically evaluate your retirement timing decision before you take the leap. It’s not just the financial numbers that you need to consider.

Sure, it can be easy to envision retirement filled with relaxing activities, such as lounging on the beach, reading a good book or golfing with friends. However, have you considered whether those activities will fulfill your mental, physical, emotional and spiritual needs over the long term? Think ahead. Once the novelty of retirement wears off, what activities will contribute to your overall happiness? Maybe you’ll want to travel the world, continue your education by going back to school or begin a new hobby.

Review your current monthly spending habits and consider which items you won’t need to budget for anymore – line items like commuting, work attire and technology expenses. Then, think about the new areas where your spending might increase, such as travel, new hobbies or volunteer and charitable activities. There are a variety of income strategies to take advantage of as you prepare for the retirement lifestyle. Consider all the possible ways you’ll want to fill your newly available 40 hours each week to build a realistic future spending plan in retirement.

Don’t forget about health care. Medicare doesn’t begin until age 65 and monthly premiums can be costly. Consider this: A 64-year-old would pay $1,123 per month for a Silver marketplace health care plan, according to ValuePenguin. (Health care premiums increase as you age. This amount is three times more expensive than the monthly cost for a 21-year-old, which is $374.) Health care options between retirement and Medicare coverage could include COBRA, the public marketplace or a spouse’s plan.

Planning for retirement can be overwhelming, but also exciting. The Covid-19 pandemic created an environment that encouraged many people to reflect on their lives, consider their values and reassess their priorities. If you’re pondering early retirement, consider asking yourself the following 10 questions to help determine if you’re ready to retire early:

- What planning have you done to ensure you’ll be able to retire early?

- What activities are you most looking forward to in retirement?

- What are your current expenses and how will they change in retirement?

- How do you plan on generating income (e.g., portfolio withdrawals, part-time work, etc.)?

- What concerns you most about retiring and what steps have you taken to mitigate those concerns?

- If you retire before age 65, how do you plan on covering your health care costs?

- Have you paid off your debts other than your mortgage?

- Have you analyzed the ways taxes may affect your ability to generate the income you need in retirement?

- What happens to your retirement plan if you or your partner require long-term care?

- How does your portfolio need to change now that you are approaching retirement?

Your Edelman Financial Engines planner can advise you on each of these aspects of retirement and help you prepare your financial picture if you are considering retiring early. Sitting down and talking with your planner is an essential step to help ensure that you are retirement ready.