Edelman Financial Engines Marks 20 Years of Helping Millions of Employees Reach their Retirement Goals through 401(k) Managed Accounts

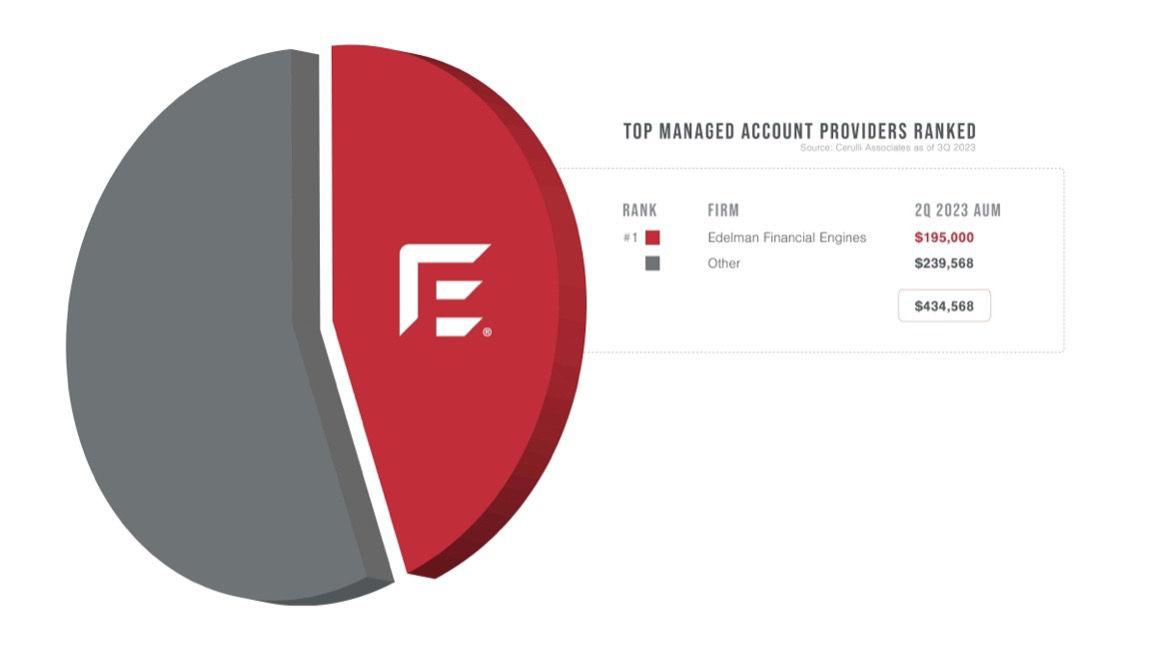

- EFE has defined the market for workplace retirement plan advice and management and today represents 45% of all 401(k) managed account assets.

- During the past decade, EFE’s data show the savings rates of managed account users have consistently averaged higher than non-users each year.

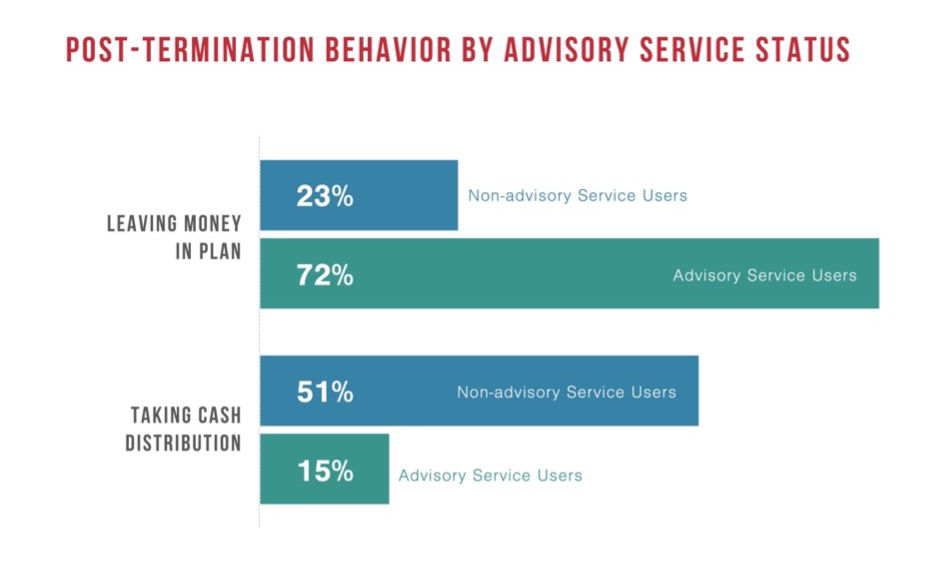

- Analysis from an EFE recordkeeping partner reveals that advisory services users are 3x more likely (72% vs 23%) than non-users to keep their assets in the plan after leaving their company – which can lead to improved outcomes for both employers and employees.

BOSTON, MA - February 12, 2024 - This year, Edelman Financial Engines (EFE), America’s top independent wealth planning1 and workplace2 investment advisory firm, marks the 20th anniversary of its industry-leading 401(k) managed account program. For more than two decades, EFE has been at the forefront of supporting employers and employees while playing an integral role in addressing the nation’s retirement preparedness. During that time, EFE has performed nearly 150 million portfolio reviews through its managed account program, while monitoring and providing personal advice and management to millions of investors on their journey to reach their retirement goals.3

“Twenty years ago, as the 401(k) continued to replace traditional pension plans as the primary employer-sponsored retirement program, we saw an opportunity to step in and offer sophisticated financial advice to employees who typically didn’t have access to independent and personalized investment management,” said Kelly O’Donnell, president of Employer Services at Edelman Financial Engines. “It’s incredible to see how the industry has progressed and innovated since then. Today, leading employers, plan providers, and consultants all recognize the important role managed accounts plays in improving employee’s retirement outcomes.”

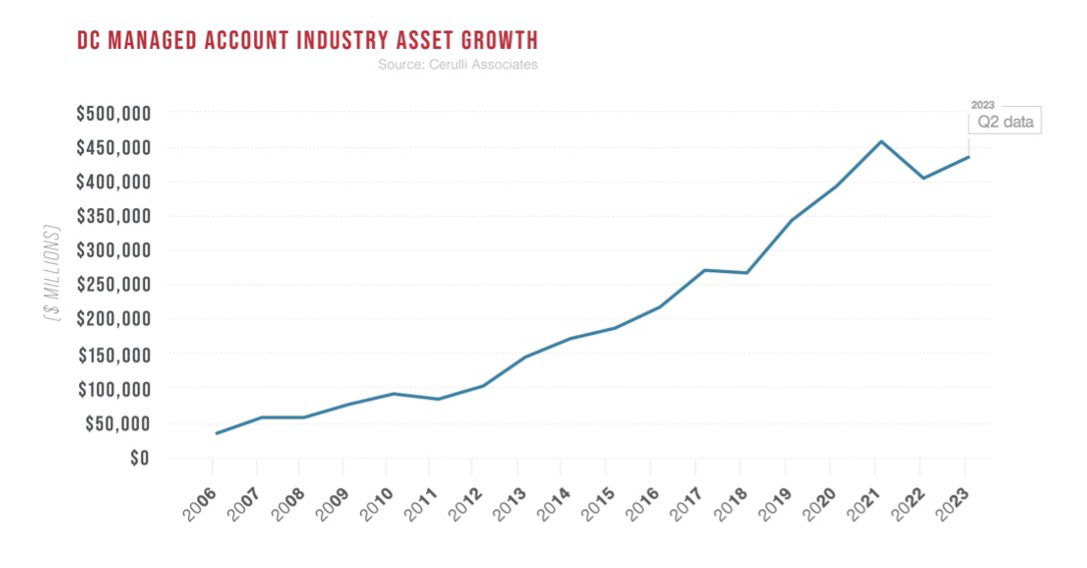

Back in 2004, EFE, led by its tech-driven Silicon Valley heritage, paved a new way for employees to save, invest, and draw down their assets in retirement. This was at a time when custom portfolios and personalization was a unique concept in the 401(k) market, and sophisticated Monte Carlo simulations were not readily available to individual investors. Today, EFE advises 1.2 million individual workplace plan participants and manages nearly $210 billion in 401(k) assets.4 The firm has been the largest managed accounts provider to defined contributions plans every year since 2008. EFE partners with many of the country’s largest employers and leading retirement plan recordkeepers to account for roughly 45% of the industry’s more than $430 billion assets under management.2

Source: Cerulli Associates data reflects the latest publishing as of 2Q 2023. EFE latest workplace AUM is $210 billion as of Q4 2023.

“In the early 2000’s, most employees did not have an independent source of help for managing their retirement assets, especially those with more complicated financial situations. Plan sponsors and providers only offered educational materials. However, for most people who lacked the time, interest, or experience to manage their retirement plans, there was an enormous unmet need,” said Andy Steiner, former Assistant Treasurer at one of the first firms to adopt managed accounts in partnership with EFE. “We had to be comfortable being a first mover with a revolutionary service making personalized portfolio management available to the masses. Now 20 years later, I am proud to see the large number of firms and employees that have embraced and benefited from the offering.”

Managed Accounts Have Enabled Positive Savings and Investing Behaviors

One of the primary benefits of a managed accounts program is the potential for increased savings. During the past decade, the savings rates of EFE managed account users have consistently averaged higher than non-users.

According to client data, program members today are contributing an average of 9.1% of their income to their account, compared to 7.8% for non-members and 7.1% specifically for individuals primarily invested in a single target-date fund.5 This translates to an average of $9,700 each year in an individual member’s retirement savings versus $8,400 for a non-member.5

Managed account members have an increased likelihood to keep their assets in the plan, protecting them from taking potentially harmful actions like cash distributions. A recent analysis of more than 200,000 plan participants from retirement plan recordkeeper, Alight (which offers the EFE managed account program to employers), found that users of managed accounts and related advisory services were 3.1 times more likely (72% vs 23%) than non-users to keep their assets in the plan after leaving their company.6 At the same time, they were 3.4 times less likely to take a cash distribution upon termination, which can trigger tax penalties and undermine savings goals.6 Keeping assets in the plan benefits both employers and employees alike. For separated employees in particular, they maintain access to professional financial advice and management at a low cost not likely available to them outside the plan.

Increased Personalization Will Shape the Future of Managed Accounts

Throughout the past 20 years, demand by employers and employees for access to high-quality financial advice in the workplace, along with regulatory changes from the Pension Protection Act of 2006, has led to significant industry growth and innovation. Today, that includes an increased focus on leveraging managing accounts and similar solutions to tackle the retirement income challenges currently facing employees.

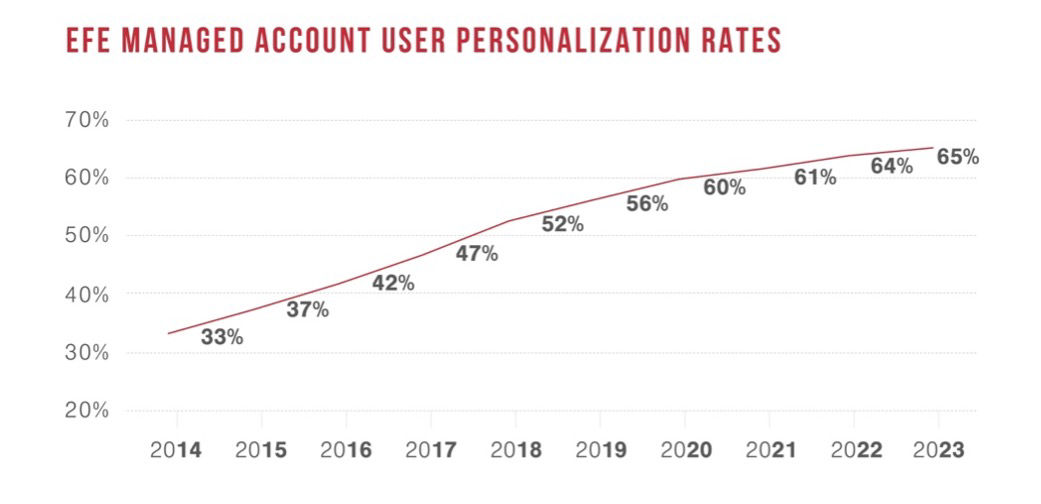

Mirroring trends in broader consumer engagement behavior and as a result of EFE’s targeted participant engagement strategies, EFE has seen an increasing number of managed account users providing more personal data and preferences (such as retirement age, risk preferences, and other investment accounts) to enable a more customized investment strategy. Analysis of its clients shows this rate of managed account members adding personal data and preferences has doubled in the past decade, from 33% in 2014 to 65% in 2023.7

“We are proud of the positive impact that we have made on employees over the last two decades. However, like many other aspects of the overall defined contribution system, we know there is much more to do to help even more employees improve their retirement and financial well-being,” added O’Donnell. "Looking ahead to the next 20 years, we expect continued change as advancements and new technologies such as artificial intelligence take hold. While we can only begin to predict where we’ll be two decades from now, the need to solve for the increasing complexity of employees’ financial lives will remain. As the industry leader, we are focused on continuing to solve for these dynamic needs by developing creative solutions to drive greater awareness and adoption of financial help, and specifically managed accounts."

To further explore this 20-year milestone, Edelman Financial Engines is hosting an online webinar with PLANSPONSOR on February 15, 2024, at 2:00pm ET to discuss the benefits of managed accounts in defined contribution plans. Learn more about the event here.

Contact

Edelman Financial Engines

PRTeam@EdelmanFinancialEngines.com

About Edelman Financial Engines

Since 1986, Edelman Financial Engines has been committed to always acting in the best interests of our clients. We were founded on the belief that all investors – not just the wealthy – deserve access to personal, comprehensive financial planning and investment advice. Today, we are America’s top independent financial planning and investment advisory firm, recognized by Barron's1 with 145+ offices across the country and entrusted by more than 1.3 million clients to manage more than $270 billion in assets.8 Our unique approach to serving clients combines our advanced methodology and proprietary technology with the attention of a dedicated personal financial planner. Every client’s situation and goals are unique, and the powerful fusion of high-tech and high touch allows Edelman Financial Engines to deliver the personal plan and financial confidence that everyone deserves.

1. The Barron’s 2023 Top 100 RIA Firms list, an eight-year ranking of independent advisory firms, is qualitative and quantitative, including assets managed by the firms, technology spending, staff diversity, succession planning and other metrics. Firms elect to participate but do not pay to be included in the ranking. Ranking awarded each September based on data within a 12-month period. Investor experience and returns are not considered.

2. According to the Cerulli Associates Top-Nine Managed Account Sponsors by DC Assets survey of Defined Contribution managed account providers, The Cerulli Edge – U.S. Retirement Edition, 3Q 2023, Issue #68, Edelman Financial Engines is the largest managed account provider by DC assets and market share as of June 30, 2023.

3. Edelman Financial Engines workplace data, as of Dec. 31, 2023. The “millions of employees/investors” data point reflects the total historic number of plan participants who at one point were managed account clients of Edelman Financial Engines. Account Reviews represents the ongoing monitoring of the member’s portfolio efficiency and allocations from 2004 to 2023. Data represents Edelman Financial Engines services on both a direct and subadvised basis.

4. Edelman Financial Engines workplace data, as of Dec. 31, 2023.

5. Edelman Financial Engines workplace data as of December 31, 2023. Data represents pretax contributions of managed account users and non-users as of year-end. Savings does not include employer match.

6. According to Alight DC Research data, as of Dec. 31, 2022. Based on 200,000 individuals who participated in plans that offered advisory services and terminated between Jan. 1, 2022 and Sept. 30, 2022. Advisory services users are considered those enrolled in Alight Financial Advisors Professional Management, Online Advice, or Personal Advisor services powered by Edelman Financial Engines. Classifications of the behaviors as follows: Participants who have a plan balance >$0 at year end and whose total distribution was $0 are classified as remaining in the plan. Participants who have taken any rollover amount, even if it is not full balance, are considered to have taken a rollover. The rest of participants are classified as taking a cashout.

7. Edelman Financial Engines data warehouse as of December 31, 2023. Reflects analysis of EFE managed account users who have personalized their account as of the year end. Cited personalization rates include historical data available as early as 2008 tracking EFE’s seven core personalization levers (risk, retirement age, Income Beyond Retirement election, outside accounts, added more positions, asset class control, and company stock personalization). EFE has in recent years begun tracking a total of 28 personalization levers, which reflect a 78% personalization rate as of September 30, 2023.

8. Edelman Financial Engines data, as of Dec. 31, 2023.

Andy Steiner and Dimitra Hannon are speaking in their capacity as a current or former representative of their respective firms that selected EFE as a service provider to make its advisory services available to plan participants. Neither the plan sponsors nor their representatives have been compensated for their testimonials.